Paragraph 3 in TREC’s One to Four Family Residential Contract is known as the “money paragraph” and has caused some confusion among realtors over the years.

Some license holders have misread and/or misunderstood what the paragraph is asking for, where to insert the monies, and which disclosure box to check for the proper addendum.

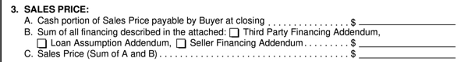

Below is a screenshot of the current form and a step by step example of where to correctly fill in lines A, B, and C and check the appropriate box.

Paragraph 3 (A) is the cash portion of the loan that the buyer will bring to the closing. This line can also be used if the buyer is paying all cash for the property. The earnest money is not part of the down payment in line A.

Paragraph 3 (B) is the amount the buyer is financing. This line would not include closing costs, PMI (Convention Loans), MIP (Mortgage Insurance Premium for FHA loans), Property Taxes, or Homeowners Insurance. In addition, this may not be the amount of the loan. The loan amount may be a larger amount based on the type of finance, loan term, or if the lender is going to roll in closing costs.

Paragraph 3 (C) is the sale price for the property. For example, the cash portion of the sales price is $10,000.

Example: The buyer is getting a conventional loan 90% financed. The sales price is $100,000. Note: it may be easier to start with C and work backward to find A and B.

- $10,000

- $90,000

- $100,000

For cash buyers, B is 0, and A = C. However, the actual cash due could be higher because of closing costs, etc.

When using a Hard Money Lender, a third-party addendum is still required to disclose the financing, which is considered conventional (all loans that are not guaranteed or insured by a government agency).

On January 1, 2016, a change was made. Financing Paragraph 4 was removed (because of the redundancy) and added to the Third-Party Financing Addendum.

The current contract has three boxes:

-Third-Party Financing Addendum- any type of financing for all or part of the purchase amount when using these loans Conventional, Texas Veteran Land, VA, USDA, or Reverse Mortgages.

-Loan Assumption Addendum– When a buyer contracts to take over or assume the current seller’s loan.

– Seller Financing- used when the Seller is financing all or a part of the purchase price.

When a buyer checks one of the boxes, they must remember to also check the correct addendum in Paragraph 22.

This article about Paragraph 3 of TREC’s One to Four Family Residential Contract is intended for reference only, and should not be considered a substitute for legal or title underwriter advice that is based on specific facts of a transaction.